Pensions are long term investments. You may get back less than you originally paid in because your capital is not guaranteed and charges may apply.

Saving for retirement often seems complicated, not least because there are several different types of pension all with their own different rules and jargon. Making sure you’ve got enough money set aside for when you retire is critical, which is why it pays to understand all the different options.

Here we explain the main kinds of pensions on offer, how they’re different and what you need to know to start saving.

Find the best personal pension plan to make your money work as hard as it can.

What is a pension?

A pension is a financial product that lets you save up to fund your retirement. Speaking technically, it’s a kind of tax wrapper that has specific rules around what you can save and when you can access your cash.

There are broadly three types of pension – defined contribution, defined benefit and the state pension.

Defined contribution

Most workplace pensions are the defined contribution type. Private pensions, including Self-Invested Personal Pensions (SIPPs) are too. With this kind of saving, the amount you get when you retire depends on how much you contributed to your pension fund during your working life, your investment returns, and the charges you’ve paid.

Whatever you save attracts tax relief, which means the government boosts your contributions. If you have a workplace scheme, your employer usually has to contribute too.

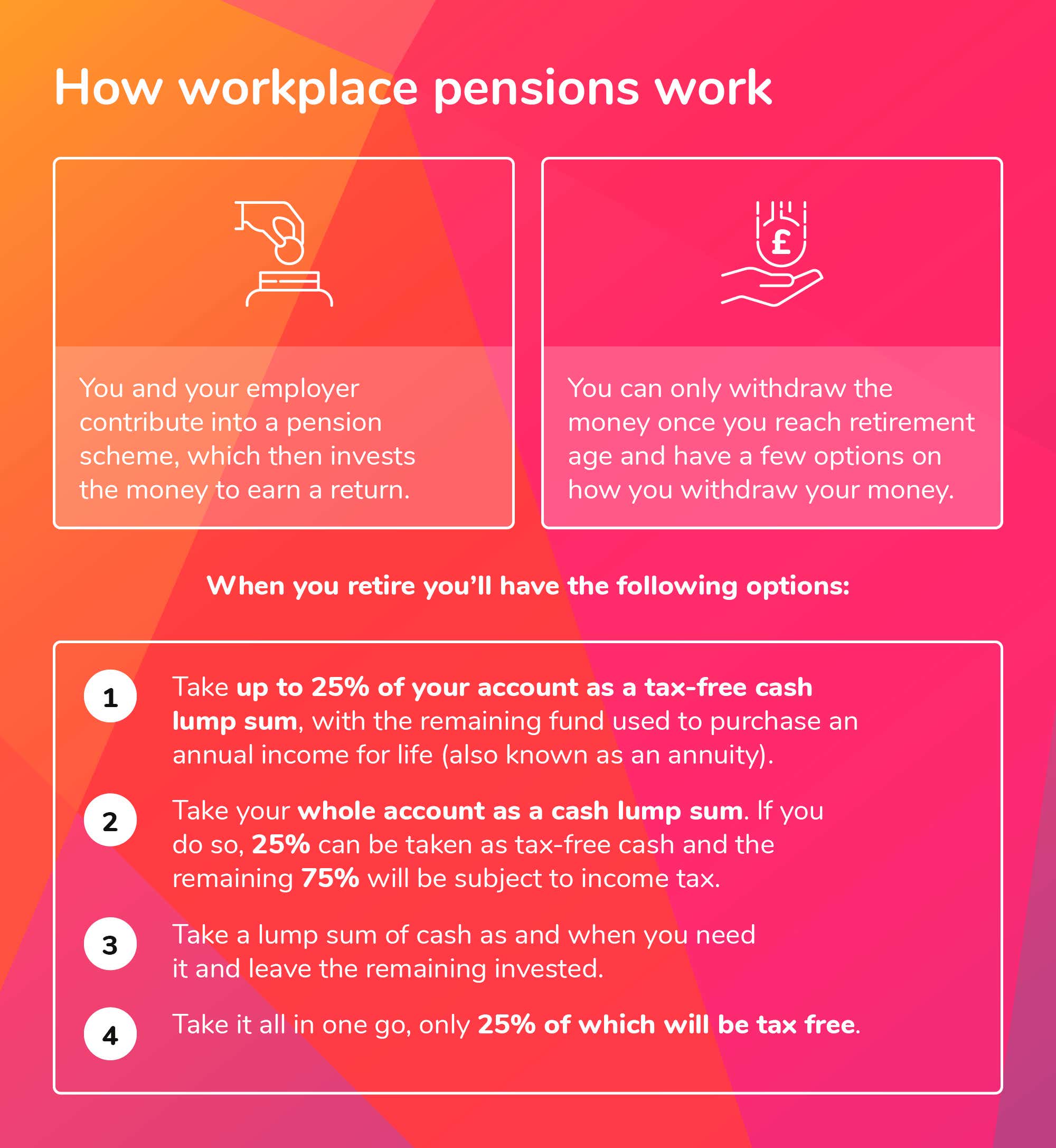

Workplace pensions are set up by your employer, and you won’t get a choice over the provider. If you earn over a certain amount a year with one company, you should be automatically enrolled. Those who aren’t enrolled automatically, because they don’t earn enough or are under 21, can usually opt to enrol voluntarily.

You can open and manage a private pension without any help and you have total choice over which provider you use. That said, it’s worth doing your research. Some platforms and providers will manage your money for you, which means you don’t have to worry about investment options. Often, they’ll ask you questions to determine your risk appetite and decide from there.

If you do want to pick and choose your investments, you can opt for a Self Invested Personal Pension or a provider that gives you fund choice. Make sure you understand the risks of investing in a SIPP before you invest, or speak to an independent financial adviser to discuss your options.

Defined contribution

These are also sometimes known as final salary or career-average salary schemes. How much you get at retirement depends on what your salary was when you worked and your length of service. You get a guaranteed income for life and don’t have to worry about investment returns.

State pension

The state pension is a qualifying benefit paid by the government. To get the full amount, you need to have 35 years’ worth of National Insurance contributions. You can also get NI credits in some cases if you are out of work – for instance if you’re looking after small children and have applied for child benefit. You can find out more about NI credits on the gov.uk site.

There are two types of State Pension, and the one you get depends on when you retire:

New State Pension: Retire after 6th April 2016

Basic State Pension: Retire before 6th April 2016

Here is more information on the State Pension

Why pay into a pension?

Even though retirement can feel like a million miles away, saving early is generally a good idea. Most people want to retire at some stage, and you need enough money to keep you going, often for more than 30 years. That means the cash you save while you’re working needs to last decades.

The more you put away when you’re younger, the more your investments will grow and the more comfortable your retirement will be. Burying your head in the sand could mean you have to keep working past the point at which you’d like to slow down. The state pension only works out at £203.85 a week, which is less than most people need to live on.

While there are many ways to save and invest for your retirement, a pension is often the most attractive because you can get:

Tax relief (free government money). When you contribute to your pension you get tax relief. In simplistic terms, this means that the government gives you free cash to top up your savings. You’ll usually get between 20% and 45% added, depending on how much income tax you pay. There’s a limit though, you can only save £60,000 a year or your total salary – whichever is lower.

Employer contributions (free money from your bosses). A workplace pension legally requires employers to contribute on your behalf. Not only do you receive contributions from the government in the form of tax relief, but you also get free cash from your boss. The minimum employers have to pay is 3%, but many will pay more if you increase your own contributions. Ask your employer if they offer contribution matching.

Pension investments are free from capital gains tax, so you won't pay tax on any profits made from the investments within your pension pots.

When you draw your pension, it counts as income, so you’ll have to pay income tax, but the first 25% is tax-free, and you can take advice to structure your payments and minimise how much tax you pay.

How do you get money from a pension?

Typically, pensions set an age from which you can start withdrawing from your pension. This is usually somewhere between 55 and 67, depending on which type of pension you have. Check your individual scheme rules to find out what’s allowed.

When the time comes to start taking money from your pension, you’ll need to decide how you want to do this.

There are several options available to you:

Private or defined contribution pensions

Buy an annuity – A guaranteed income for life, provided by an insurer.

Drawdown – A flexible retirement income where you draw money from your pot as and when you need it.

UFPLUS – A series of lump sums.

Cash - Take your whole pension all at once. This is rarely a good idea unless you have a very small pot.

You can choose to mix and match any of the options above.

Whatever route you take, you typically get 25% of your pension pot tax-free (up to a limit of £268,275), and anything remaining will be subject to income tax. The more your annual income, the higher your tax rate – just like with a salary.

Defined benefit pensions

Your DB pension will give you a guaranteed income for the rest of your life. This will usually be paid weekly, monthly or annually depending on your scheme rules. You pay tax at your marginal rate.

You may be able to take some of its value as a tax-free lump sum in return for a lower annual income, but this will depend on the rules of your scheme.

Pension FAQs

How much can I pay into my pension?

The annual allowance is £60,000 a year. Above that, you’ll have to pay a hefty tax bill. You'll also face charges if you pay in more than your annual salary - even if it's less than than £60,000 a year.

Can I withdraw from a pension?

You can withdraw cash from your scheme once you meet the retirement age laid out in the rules. Some schemes will allow you early access, but there’s a penalty involved.

Can I manage my own pension?

If you have a workplace pension, it’s managed for you by a team of experts. However, some schemes will allow you more control, for instance over how your savings are invested. If you have a SIPP you have full control over the choice of provider and fund selection.

Can I transfer my pension?

Some workplace pensions and SIPPs can be transferred, but make sure you consider any charges for doing so. This guide explains more.

Does my employer need to pay into my pension?

Yes, but only if you are an eligible employee. Find out more information here.

Find the best personal pension plan to make your money work as hard as it can.